Quick Links

[MUSIC PLAYING] SPEAKER 1: Have you ever received a bill that you didn't expect? And wouldn't it be nice if that wasn't allowed? Like, I'm sorry, you are not allowed to charge me that. Well, guess what? Texas passed a law that prevents some of those surprise medical bills, but the law doesn't apply to everyone in every situation. So listen up, and we'll tell you how to protect yourself.

First, let's get everyone on the same page. Do you know what it means to be in-network or out-of-network? I'm not talking about your friends on social media. I'm talking about your health insurer's network of doctors, hospitals, and other health care providers. When you visit a doctor or other provider who isn't a part of your insurer's network, you're seeing an out-of-network provider, and out-of-network providers may send you a bill for amounts on top of what your insurer already paid for the care you received.

It's called balance billing, or surprise billing, and it can get really expensive. Some people have gone bankrupt trying to pay a surprise bill. Bankrupt. So how do you know who's in-network? Well, look for your insurer's provider network search tool. Blue Cross and Blue Shield of Texas members can find a provider on our app or our website. Tools like these can help you locate doctors, and specialists, hospitals, and pharmacies that are in-network.

You can also call the number on the back of your ID card to ask for assistance locating an in-network provider. Easy enough, right? Well, usually it is. Unfortunately, sometimes even if the facility you visit is in-network, the doctor who treats you could be out-of-network. For example, your surgeon and your hospital could both be in-network, but what about the anesthesiologist who treated you during your procedure?

They could be out-of-network. Similarly, you may have had a blood draw that your in-network doctor's office did, but then your physician could send your lab work to an out-of-network lab. Both of these situations can lead you to receiving a surprise medical bill through no fault of your own. It seems unfair, right? Well, Texas lawmakers thought so too.

Fortunately, a new law protects some Texans from surprise bills, especially in situations where you don't have a choice in where to get care. This law takes the patient out of the middle. It places the negotiating responsibility where it belongs, on the health care provider and the insurance company. With this new law in place, providers should not send you a surprise bill for amounts above your deductible, copay, or coinsurance, and this applies to three types of situations.

You should not get a surprise bill for emergency services and supplies. You shouldn't receive a surprise bill from an out-of-network provider who treats you at an in-network facility, like the anesthesiologist that I mentioned. And lastly, you shouldn't get a surprise bill when you're in-network doctor uses an out-of-network provider for diagnostic imaging or lab work.

In these last two situations that don't involve emergency care, there's another exception, and we're going to talk about it in a minute. The law is already in effect, and the rules apply to any care you received on or after January 1, 2020. However, there are some exceptions to the rule. It's important to know that this law does not apply to all health plans. It only applies to fully insured state regulated plans issued to groups and individuals through HMOs, and PPOs, and EPOs.

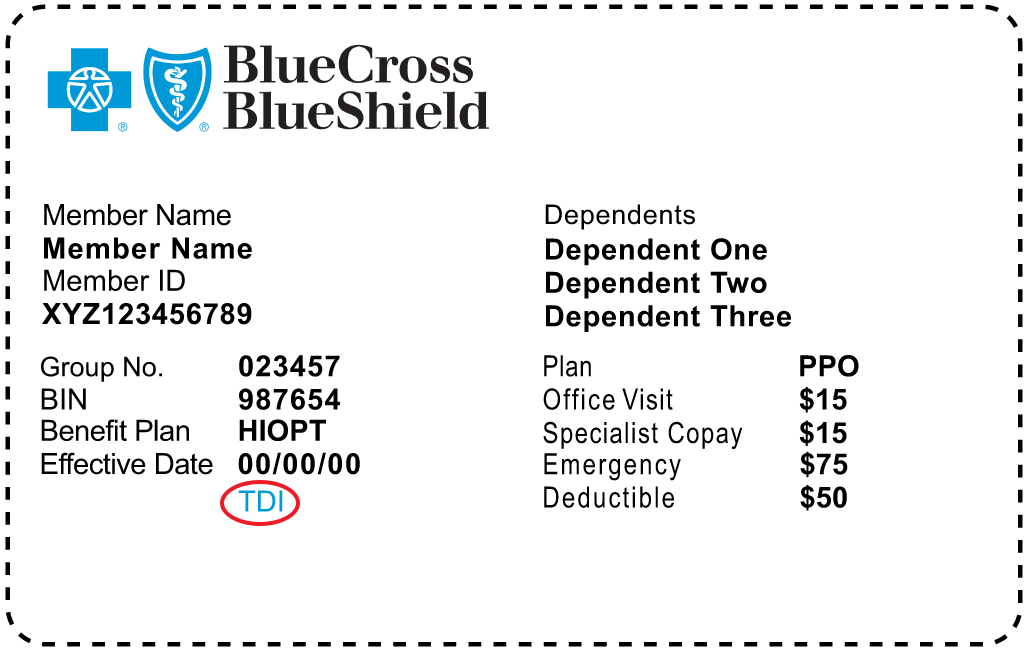

And you might be thinking, OK, how am I supposed to know if that includes me? Well, you can tell by looking at your ID card. The law applies to anyone with a Blue Cross and Blue Shield of Texas ID card that has TDI printed on it, and it might apply if you have DOI on your card. It does not apply to Medicare. It also doesn't apply to many employer sponsored plans, with the exception of ERS and TRS. They actually are impacted.

So just play it safe. Call your insurer to find out if this law applies to you. There's another important exception we should talk about. If you visit a health care provider outside your network, they may ask you to sign a form before they provide care. This form gives them the right to balance bill you, because you're choosing to receive out-of-network care.

OK, this form, it looks like this. And the provider must give it to at least 10 business days before the service is performed. By signing the form, you agree to pay more for out-of-network care and give up important legal protections. If it were me, I'd think long and hard before I'd agree to waive my rights for consumer protection. So what happens if you sign now and then you regret it later?

Well, you have five business days to change your mind and revoke your agreement after you sign the form. And members who sign the form still have the right to appeal their claim following the standard claims appeal process described in your health benefit plan. You should also know that there are some situations in which the doctor can't ask you to sign a form allowing them to balance bill you.

OK, so I know that was a lot of information to hear all at once. That's why Blue Cross also made it available on bcbstx.com. You can come back to it later. Just click on Find a Doctor or Hospital, click on the tab, click Know Your Network on the left side, and then you'll find these tips in the stay in-network section.

Still have questions? Call the number on the back of your ID card and a customer advocate will walk you through the options. You can also call the Texas Department of Insurance at 1-800-252-3439, or go to tdi.texas.gov for more information.